Innovation and

|

IP Monetization in China

Ant Group’s record-breaking IPO in A+H shares stock markets and its sudden suspension was the hottest issue in the past few weeks in global financial markets. More than three months ago, when this historical IPO was announced, the deafening "voice of freedom and wealth" was heard throughout Hangzhou. On November 3rd, Chinese securities regulators abruptly called a halt and gave tens of thousands of shareholders involved in the IPO a blow and a shout. The sensational news had even overwhelmed the raging US presidential election across the ocean.

What is the most valued asset of this capital-giant-to-be, apart from its lucrative financing business? It's intellectual property! According to the prospectus, Ant has 26,279 patents applied or granted, 8,569 trademarks, 677 copyrights, 3,927 domain names, and 369 design patents and trade secrets in 40 countries and regions at home and abroad, covering the technology areas of artificial intelligence, risk control, security, and blockchain.

In-Kind Investment Plays a Role Of these patents, 90% were transferred to Ant in exchange for a one-third shareholding as in-kind investment from Alibaba Group priced at CN¥12 billion. (How did Alibaba accomplish this? See our previous article “New ‘In-Kind Investment’ Rules for Monetizing IP in China”). By Ants' estimated market capitalization of about CN¥2.1 trillion, the US$12 billion has become CN¥700 billion. Owning the original intellectual property rights can really pay off! (60 Times)

Actually, Innovation’s Crouching Tiger (found on ictiger2020.com) has surveyed and analyzed the advantageous IP positions established in fintech by Alibaba (as well as other leading Chinese companies). It also discusses their potential of IP monetization and impacts on the global innovation ecosystem

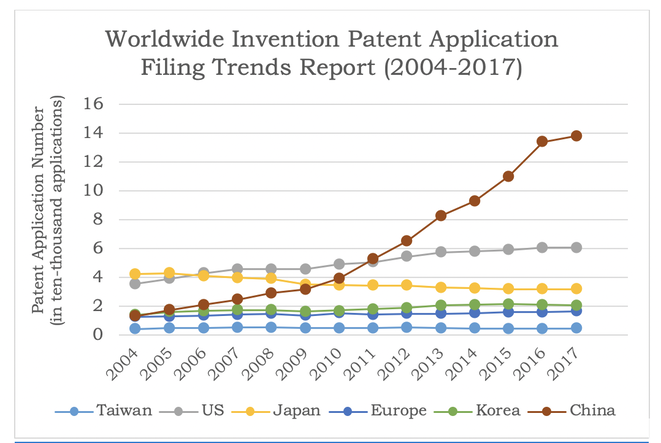

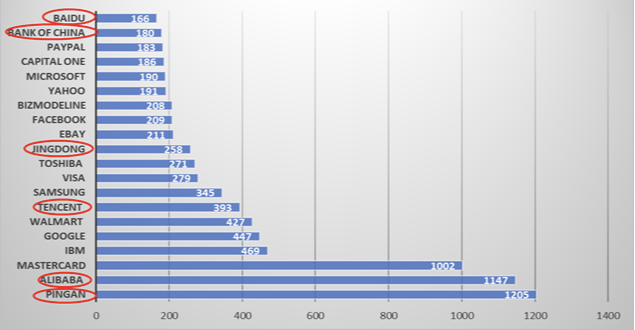

The Formation of Sizable IP Pools China is well-known for its large population, consumption, and foreign exchange reserves, among many other economic facts. Small variations to the large volume of these economic factors often cause changes of a magnitude that makes the global economy take notice. This dynamic of small shifts causing changes in a large sector of the economy holds true for the IP sector too. This is good news for IP monetization. The voluminous base of IP may serve as a potential “IP pool” for monetization deals and to increase the value in the value chain activities. The sizable volume can best be understood through a comparison with other global players illustrated in chart 1. At the global level, the volume is also growing astonishingly quickly. This is happening not only in China’s total numbers but is also true for certain industries, a fact that has strategic implications for the next generation of technologies. Fintech as Ant Does At the industrial level, patents relating to the application of AI and big data in financial technology (fintech) provide an example. Fintech will serve as an essential part of modern service industries in the coming years. Those who dominate fintech will most likely extract the greatest value from the sector’s robust growth. Ant’s IPO has provided us with the best example. The statistics in chart 2 show more than three Chinese players (i.e. PingAn, Alibaba, and Tencent) who have occupied a strategic position through their accumulation of patents in these areas.

Chart 1: Worldwide Invention Patent Application Filing Trends Report (2004-2017)

The Top Twenty Companies by

Fintech Patent Application Number (2018)

Chart 2: The Top Twenty Companies by Fintech Patent Application Number (2018)

Who is the next star expected to achieve great commercial success based on their IP advantages? How does China’s innovation ecosystem nourish those innovative giants and how does the regulatory regime shape their development, like the story of Ant’s IPO? More details are revealed in Innovation’s Crouching Tiger and our coming blog serial, The STAR Market Report.

1 Comment

11/22/2023 03:43:44 am

What are the advantages of real estate investment?

Reply

Leave a Reply. |

Categories

All

|

RSS Feed

RSS Feed