Innovation and

|

Topic # 3: Legal issues in IP securitization

The legal issues of IP securitization refer to the legal issues arising from the issuance of intellectual property securities based on the traditional asset securitization structure. Since IP assets have different attributes from traditional securitized assets (such as real estate or account receivables), they will generate unique legal risks.

The legal and business community have largely resolved such legal issues. It has been two years since the development of IP securitization in China. The total annual issuance volume has surpassed tens of billions of RMB, which shows that the market has recognized the solutions.

There are two types of legal issues worth investigating.

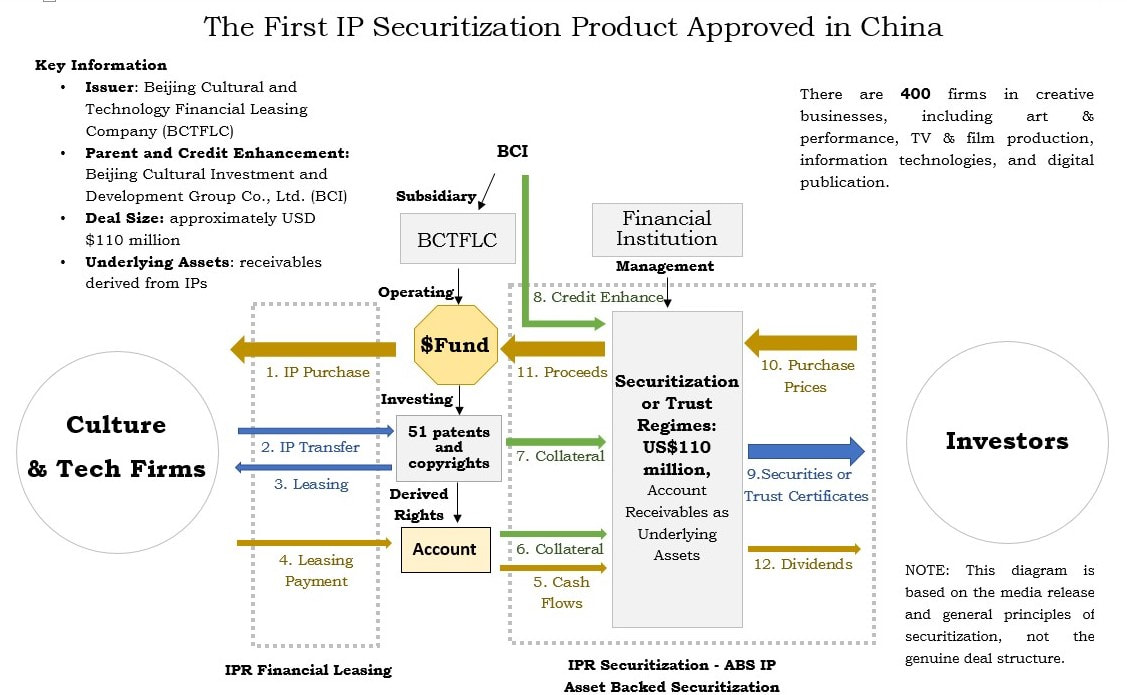

The first type of issue does not constitute a barrier to issuance in practice, but is valuable in academic theory and legislative optimization. For example, the chart above shows a typical intellectual property securitization structure. Parts two and three together represent a "double licensing" transaction, which may seem unnecessary at first, however this piece serves to make the securitization structure possible. We can better understand "double licensing" in the following points:

Most legal professionals are not familiar with this transaction model of "double licensing". These situations may also be unbeknownst or unforeseen by legislators writing laws to regulate patent licensing. Despite its obscurity, this licensing model has obtained confirmative legal acknowledgement and is also recognized by the market. The only wrinkle is with the State Intellectual Property Office, which refuses to log the second licensing registration. On IPfinance.cn, we explored this attitude from the perspectives of legislation, administration, and economics. The second type of legal issue lies in the exploration of IP finance. We will encounter such issues when we break away from the traditional definition of securitization and explore other novel ways to develop intellectual property finance. For example, NFT and music IP combined can issue music securities. This kind of security can be formed by the segmentation of IP ownership itself. This approach is very different from the existing securitization structure of intellectual property rights, which is based on the segmentation of the cash flows from the IP. Issuers will need to tackle with whole new legal issues in such novel securitization structure. Such novel IP securitization structure may be advantageous in certain aspects. For example, it can facilitate transactions in the global market. Therefore, perhaps the next IP to be transferred abroad will be trasnferred through securitization. However, exploring this new field will inevitably involve more cross-border cooperation. In our current environment, it still needs international industry experts to better understand the development of China's innovation environment, laws, and intellectual property system before working together on such transactions. In the ICTiger Project, we are introducing China's innovation ecosystem to the world in English and hope that this effort may prompt international cooperation of IP finance to create a more mature and expanded market for innovative and creative industries. Conclusion In 2021, IP finance in China has witnessed significant and rich development during the recent tech boom, domestic and foreign policy changes, and the ongoing epidemic. Each of the ten most significant topics from IPfinance.cn can reflect the opportunities and challenges of protecting and applying intellectual property rights in the new era. Because of limited space, this article discusses the first three. We welcome like-minded readers join us to explore other topics that also greatly impact the development of innovation in China and the rest of the world. Gain further insights by visiting our blog at ICTiger2020.com or follow us on Facebook @ICTiger2020 for more related news updates. Feel free to contact the author at [email protected].

0 Comments

Leave a Reply. |

Categories

All

|

RSS Feed

RSS Feed