Innovation and

|

IP Regime in ChinaIP Monetization in China

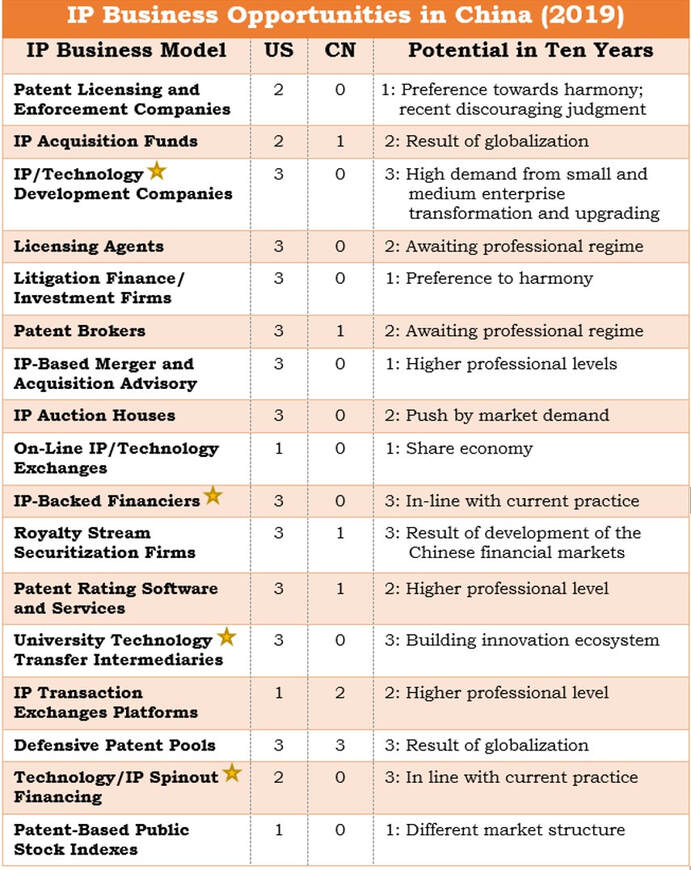

Government policy and social media are stimulating interest for exploring IP business models in China. SpringIP Group conducted a survey and identified the top 3 business models with the most potential for IP monetization in China in the coming years.

Interests in exploring IP business opportunities among Chinese IP professionals were inspired by the success stories of the Getty Museum, Intellectual Ventures, and global research institutions (such as MIT), all of which operate profitable models based on IP monetization. This interest group was once small; however, in the past few years, thanks to the government policy and the long-tail effect of prevalent social media, the discussions, debates, and experiments of new IP business models have arrived at a new level within this interest group, and have even gone beyond this circle to become a hot topic in the business community.

As China’s IP regime develops, more proven business models from developed countries are now starting to flourish in China. Take IP securitization, IP brokerages, and patent-based public stock indexes for example. In 2019, SpringIP Group – a company dedicated to enterprise innovation through AI and big data – published a survey about this phenomenon. Using a framework from previous researchers[i], SpringIP applied its proprietary methodology to the information and opinions collected in the US and China. SpringIP’s methodology for this survey consisted of four steps: 1. Assigning a rating (0-3) to each IP business model in the US and China reflects the business model’s current level of activity in these two countries. The ratings are based on the thoughts and opinions of SpringIP’s founders and their peers working in IP, finance, and high-tech industries. 2. Compare the two ratings. A larger difference between the two ratings hints a larger vacancy to fill with new services. The demand for new services is assumed to grow along with China’s industrialization, following the path that the US has traveled. 3. Adjust the potential difference regarding other influential factors, such as business cultures, China’s development plans, sizes of talent pools, or levels of professionalism, as essential to the success of the relevant models. Namely, a large vacancy does not necessarily mean a larger commercial potential, if other factors are unavailable to support the growth of that particular model. 4. Assigning a conclusive rating (0~3) in light of the above analysis, with three representing the most attractive opportunities. The three examples below illustrate how this methodology provides useful insights into IP monetization in China. 1. The “University Technology Transfer Intermediaries” model is a rising star For example, the business model “University Technology Transfer Intermediaries” presents an opportunity vacancy (difference = 3). In addition, the Chinese government has a significant budget to build “innovation ecosystems”, with reference to the successful models of MIT in Cambridge or Stanford in Silicon Valley. As such, the survey concludes that this business model has great potential (rating 3). 2. The “Defensive Patent Pool” model continues to grow The model “Defensive Patent Pool” provides an example showing how an influential factor increases the commercial potential of a particular model. This particular model does not present a huge vacancy (difference = 0), meaning that the relevant activity level in China is similar to that in the US. However, this business model will continue to grow strongly, because more and more Chinese companies are globalizing their operations, resulting in stronger demand for the services of defensive patent strategies. The survey concludes that this business model also has great potential (rating 3). 3. Stay away from the “Patent Licensing and Enforcement” model The “Patent Licensing and Enforcement” model illustrates the influence of business cultures. In the US, a Non-Practicing Entity (NPE) (i.e., an entity which owns but does not develop its patents like Intellectual Venture mentioned above) is a well-established model to monetize IPs. A similar model is just now emerging in China, so the difference is large (difference =2). However, such a business model has no potential in China in the next ten years for two reasons. First, Chinese culture tends to favor harmony over confrontation. The business community does not completely embrace the idea of the western adversary judicial system and this business model relies on litigation and effective enforcement. Second, Chinese courts are acting in lines with a global trend that becomes less friendly to NPEs, as exemplified in the America Invents Act (AIA) enacted in the US in 2011. For these reasons, this model received a rating of 1. In conclusion, SpringIP Group adopted the mentioned methodology in the survey and identified the top four most promising IP business models in China for the next ten years. As summarized in the following table, these promising models include “IP/Technology Development Companies”, “IP-Backed Financiers”, “University Technology Transfer Intermediaries”, and “Technology/IP Spinout Financing”. SpringIP Group is assisting several Chinese innovators in the adoption and effective implementation of these business models. [i] See the framework in, A Summary of Established & Emerging IP Business Models, by Raymond Millien PCT Capital LLC and Ron Laurie Inflexion Point Strategy LLC – 2008.

IP Business Opportunities in China - surveyed by SpringIP Group (智汇权科技) in 2019

Legend

Levels 0-3, with 3 standing for the highest potential or most attractive opportunities “In line with the current practice”

“Awaiting professional regime”

“Higher professional level”

“Recent discouraging judgment”

(Dr. Jili Chung is currently working in Greater China, founding SpringIP Group, dedicated to foster enterprise’s innovation through AI and Big Data tools. Carlo Geremia has also contributed to this article.)

0 Comments

Leave a Reply. |

Categories

All

|

RSS Feed

RSS Feed