Innovation and

|

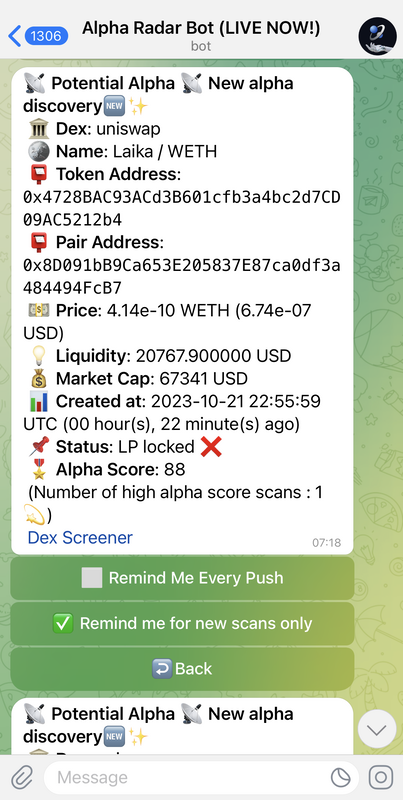

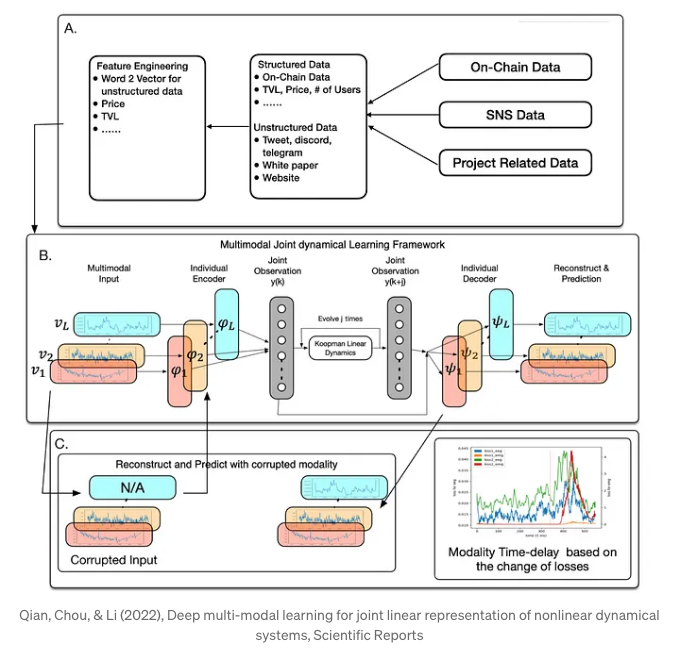

Digital asset management is becoming a trend, and AI is stepping on the gas. International investment institutions are accelerating their entry into the digital asset market [1], believing that asset tokenization will become a trend. They estimate that digital assets will account for 10% of global GDP by 2030[2]. These institutions believe that tokenization can reduce friction in asset circulation, significantly reduce transaction costs, and increase transaction security, which will disrupt the current industry ecosystem. In this climate, the amount of data that can determine the value of assets will blow up. Investors will be able to analyze investment strategies more scientifically, but existing data capture and analysis tools are no longer applicable, making AI the preferred alternative tool. The First AI Digital Asset Investment Radar in the Chinese-Speaking World AI digital asset management has become a focus of attention for global investors, including in the Chinese-speaking world. These teams have made initial achievements by fully utilizing the resources accumulated in the Chinese-speaking world, the relaxed environment in Hong Kong and Singapore, and the experience of mature IT engineers and AI implementation. Among them, the Alpha Radar Bot project (project link) stands out as a representative example. They use artificial intelligence and machine learning methods, as well as the alpha scoring mechanism, to filter the collected on-chain data and information from social media platforms, identifying digital asset projects with sufficient growth potential. In the traditional investment theory, alpha refers to a performance measurement indicator. It represents the difference between investment performance and overall market performance after removing the effects of market fluctuations and random fluctuations. Introducing this concept into AI digital asset management is a pioneering move by the Alpha Radar Bot project. The Google of the Web3 Era The project team has ambitious goals. They start evaluating projects from the first day they enter the liquidity pool, hoping that, just like how Google’s SEO algorithm rates web pages, Alpha Radar Bot can rate Web3 projects. After the project was launched, it immediately gained attention in the region. It received support from two Web3 institutions, Hashkey Capital and Bing Ventures. The project founders were invited to participate in a closed-door project incubation conference held in Singapore and shared insights into "AI digital asset management" alongside top projects in the field such as TON Foundation and Lootbot Partner. Immediately after the conference, they received invitations from various venture capitalists to learn more about the benefits of the project. One of the advantages of Alpha Radar Bot is its AI methodology. They extensively collect on-chain, private social media domain information online to train large-scale data models. This approach actually shares similar insights with the M-I-T methodology (patent number ZL201811587962.6) developed by another innovative team in the region called Zhihuiquan (i.e., SpringIP). The difference is that Alpha Radar Bot is the first to apply it to the identification of digital assets in all fields, while the SpringIP team focuses on insights into IP-related digital assets. Is IP Digital Asset Management Becoming Mainstream?

SpringIP’s concept of IP goes beyond intellectual property including a broader range of intangible assets. Digital IP assets have properties that defy common intuition, requiring different management and valuation approaches. Compared to physical items that are consumed, IP assets increase in value with more use. For example, the market value of a song sung by one person is certainly not as high as the market value of the same song sung by ten people. The contribution from IP consumers, which was difficult to record in the past, can now be easily and quickly confirmed through smart contracts and Web3 business models. As a result, the relationship between IP producers and consumers is becoming blurred, and the judgment of the value of IP digital assets may undergo a paradigm shift. Chinese-Speaking AI Digital Asset Management: A Battle of a Hundred Flowers Currently, SpringIP is collaborating with Alpha Radar Bot to combine their strengths, improve the accuracy of AI predictions by narrowing down the categories of digital assets into IP assets, in order to to increase investment returns. By leveraging the characteristics of IP assets, they aim to facilitate the flow of resources between traditional asset management and digital asset management, allowing financial elites familiar with traditional asset management to quickly enter the era of digital asset investment management. Similar strategic collaborations and explorations are happening extensively and intensively in the region. Perhaps the Google of the Web3 era will emerge among the entrepreneurial teams in the Chinese-speaking world. Gain further insights by visiting our blog at ICTiger2020.com or follow us on Facebook @ICTiger2020 for more related news updates. Feel free to contact the author at [email protected].

0 Comments

Leave a Reply. |

Categories

All

|

RSS Feed

RSS Feed