Innovation and

|

IP Regime in ChinaIP Monetization in China

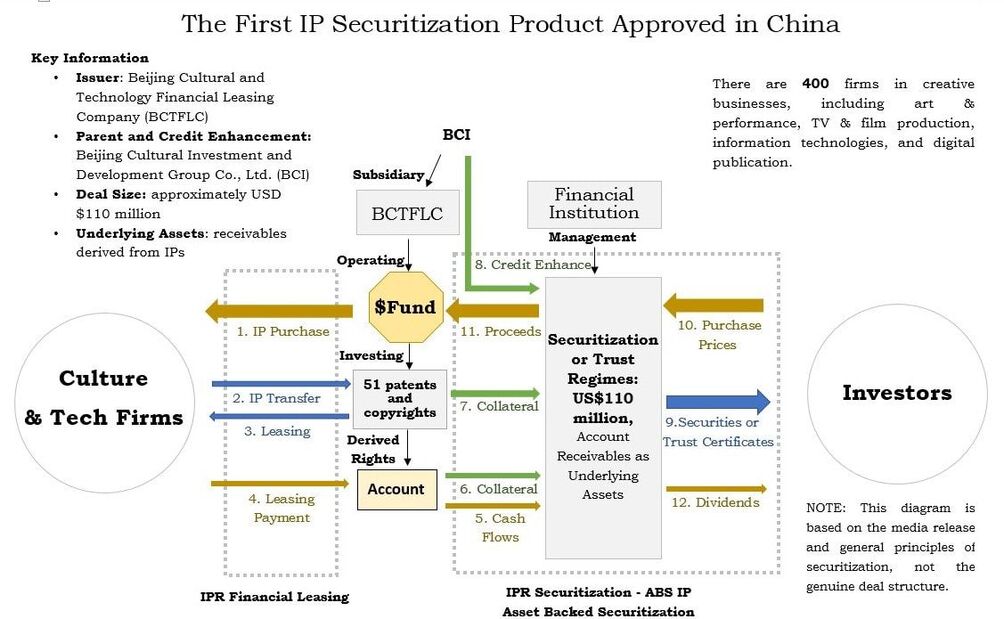

The issuer in the first IP securitization deal was the Beijing Cultural and Technology Financial Leasing Company. Its parent company, Beijing Cultural Investment and Development Group Co., Ltd., provides credit enhancement through a guarantee. The deal size is about US$110 million. The underlying assets for securitization are receivables derived from various IPs, mainly consisting of copyrights, some trademarks, and very few patents in information technologies. The IPs are pooled from 400 firms in creative businesses, including art & performance, TV & film production, information technologies, and digital publication.

A step-by-step illustration of the structure of China’s first IP securitization deal: 1. The issuer maintains a fund and uses it to acquire the IP from the original owners, i.e., 400 companies in the culture, creative, and information technology industries. 2. The ownership of the IP (51 patents and copyrights) are transferred to the issuer. 3. The issuer leases the IP back to the original owners. * 4. The original owners pay rental fees to the issuer. Such periodical rental payments become the account receivables (cash flow) to the issuer. 5. The issuer assigns the rights to future cash flow generated from the account receivables to a special purpose vehicle (SPV) used to issue securities. 6. The issuer pledges the accounts receivable of the periodical rental payments to the SPV. ** 7. The issuer pledges the IP as collateral to the SPV. *** 8. The issuer’s parent company, a giant group company with strong financial resources, provides a guarantee that the issuer will fulfill the cash flow up to the promised level, otherwise the issuer’s parent company will fill in the gap. 9. The SPV issues securities to the investors with terms and amounts matching the promised cash flows. 10. The investors pay for and acquire the securities. 11. The payment from the investors for the securities become the proceeds of the SPV. *Accordingly, the original owners can continue exploiting their IPs. **In case the cash flow falls below the promised level, the SPV may dispose of the collateral (account receivables derived from the IP) in exchange for the liquidity. *** Similar to Step 6, in case the cash flow falls below the promised level, the SPV may dispose of the collateral (here, the IP itself) in exchange for the liquidity.

Legend

The numbering refers to the order of steps taken in the process of the IP securitization product approval. The dotted-lined box on the left: The overall deal consists of several transactions, which belong to two distinctive financing activities, i.e., financial leasing and asset-backed securitization. The left box contains the underlying transactions (steps 1 to 4) building up to the financial leasing. The dotted-lined box on the right: The right box contains the underlying transactions (steps 5 to 12) building up to the asset-backed securitization. The yellow arrows (gold): Three kinds of legal considerations are exchanged in the above transactions. They are money, rights, and liabilities. The arrow in yellow depicts the flow of money. To focus on the arrow in yellow will see how the money flows in the markets as a medium of financing. It flows from the inventor/creators on the left to the capital markets on the right, through a designed deal structure, and then flows from the capital markets back to the inventors/creators. This cycle of money flow illustrates the essence of securitization as an effective tool to finance invention and creation. The blue arrows: The arrows in blue indicate that rights are transferred as legal consideration. For example, in step 2, the inventors/creators are transferring out their IP rights. The green arrows: The arrows in green indicate obligations/liabilities are assumed in order to complete the underlying transition. For example, in step 8, BCI provides a guarantee for due payments to the investors who hold the trust certificates.

0 Comments

Leave a Reply. |

Categories

All

|

RSS Feed

RSS Feed